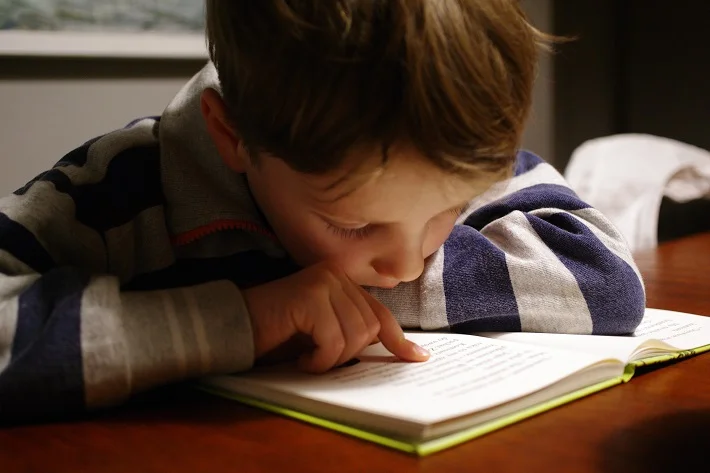

As they say, parents are the first teachers for any kid. While schools are the places they go to study theoretical things, it is a parents’/guardians’ responsibility to equip the kid with real-life skills. And what better skill would be than managing money? One major step towards this would be to get them a savings bank account for minors.

Managing money is a complicated task even for most adults. This can be blamed on the unpractical teaching systems from younger ages. But thankfully, there are modern solutions. You can now equip your kids with this wise knowledge from a young age. One of the ways to begin with it is to open savings bank accounts for minors.

A minor bank account will help teach your kids about financial literacy. They will be able to deposit funds, learn how the account grows and earn interest in the process. Managing their money will help them understand the pros and cons of saving money.

But like all the things in the world, this comes with repercussions too. As a minor bank account will enable them to withdraw and deposit money themself, there can be dangers too. This article will cover the potential benefits, pitfalls, and other aspects you should know before opening a bank account for minors.

Also read:

Things to know before opening Bank Account for Minors

Before opening bank accounts for minors, you must have a clear purpose for opening the account. You must understand the big picture in this scenario. What are your goals, and what purpose will this minor bank account accomplish? The answer could be anything from making your kid understand money or helping them save for their future. Once you have this understanding, choosing what kind of account best suits your needs becomes more effortless.

Apart from understanding your goals personally, it is also difficult to open bank accounts for minors from banks’ perspectives. The banks need their clients to sign an agreement before opening a bank account for minors, just like any other account. With people under the age of 18, this becomes a little complicated.

There are different State laws and Corporate policies that create a lot of additional complications. Because of these complications, banks are reluctant to open a bank account for minors. Unless an adult is involved on the account, they rarely come on board.

Also read: How To Check SBI Account Balance Online

How to Open a Bank Account for Minors?

You must check a few things before opening a minor bank account. These include:

- Find a bank that offers the features that are the most valuable and suitable for you. You must align the features with your goals and then make a decision.

- Noting the minimum deposit required to open the account along with the ongoing balance requirements is very important. This will give you a clear idea of how you want to maintain the bank account for minors in the long run.

- Understanding the monthly fee structure, if any. All the banks have different approaches to it. But it would help if you were thorough with it, as these fees can eat up your savings.

Just like all other accounts, some basic things are required to open a bank account for minors. The only difference is that here you’ll need the documents of the minor and the adult involved. The typical requirements include:

- Full name

- Social Security number or tax ID number

- Physical address

- Valid government identification details

Knowing the requirements prior helps in easing the process. You can even link an external bank account with this minor bank account. Through this, you’ll be able to deposit the money electronically into this new minor bank account.

Types of Bank Accounts for Minors

You can choose what kind of minor bank account you and you’re minor would want to opt for from various options. The type of minor bank account you select should match your financial goals.

Here are some examples of different bank accounts for minors and their features. You can match them with your individual needs and make a decision well informed.

1. Joint Bank Accounts for Minors

If you have a goal for the minor to learn and use the account, then the joint bank account for minors could be the thing for you. As they will be using it themselves for basic depositing and money withdrawals, it is good to go for joint bank accounts for minors.

Banks generally market this joint account as “kids bank account” or other names to target the audience. An example is the “Money teen checking account” from Capital One. This joint bank account for minors is available for kids aged 8 or above.

Joint bank accounts for minors are designed such that the adults associated with this account are looped in for all the activities in the account. Parents generally enable text or email notifications linked with the minor bank account. This allows them to check overspending or suspicious uses of the debit card. They might also be eligible to suspend the access to debit cards for their minors.

However, as the minor turns 18 or the state’s age of maturity, things change as per the policies. Before signing up for joint bank accounts for minors, you must be thorough about these policies.

2. Custodial Bank Accounts for minors

These are the accounts that adults open and manage for their kids. The custodial bank account for minors enables the adult to save on behalf of the minor. Unlike joint bank accounts for minors, the adult is the sole person with the access to withdraw or deposit money. Though the adult manages the money, the minor in whose name the account is created remains the owner of that money.

This continues till the minor reaches the legal age of maturity. Hence, as the child turns 18, or whatever the legal age limit, all this money can now be handled by them as adults. They now have a choice of how they want to spend the money in their previously custodial bank account for minors.

Also read: ICICI Child Education Plan 2024 – ICICI Smart Kid Plan

3. Education Accounts

A number of bank accounts for minors are available solely to cover the education costs. These bank accounts for minors generally come with tax benefits easing the humungous school payments.

A few of the options for these Eduction minor bank accounts are:

- 529 college savings plans: This bank account for minors allow you to save in an account and spend tax-free money on education expenses. As long as you meet the relevant tax laws, these make for a powerful and intelligent means to save up for education.

The 529 Education Plans can cover the higher education costs, along with $10,000 per year for K-12 tuition. Trade schools, room and board, overseas institutions, and other expenses for graduate school or college comes under the umbrella of higher education.

- Coverdell Education Savings Account (ESA): This type of minor bank account also helps pay education expenses with tax-favored dollars. The one catch is that the maximum contribution is relatively tiny annually. This means that you’ll have to start saving super early or look for other ways to supplement this money. On top of that, not everyone is eligible for an ESA, making it all the more complicated.

4. Prepaid Cards

If your main goal is to enable card payments, you can opt for prepaid cards. However, these cards don’t have anything special to offer than a checking minor bank account can. Plus, they are notoriously expensive. Whereas the bank accounts for minors might have temporary fee waivers or no fees at all. All this makes the bank account for minors a much better option.

Opening Bank Accounts for Minors with SBI

The bank accounts for minors in SBI are called “Pehla Kadam” and “Pehli Udaan”. These complete solutions help kids learn about money-saving wisdom.

These minor bank accounts come with all the available major banking features. These include Internet banking, Mobile banking, etc. Enabling these features fulfills the purpose of teaching the kids to understand money and technology to the core. And of course, all these features come with the ‘per day limits’ cap to ensure no ruthless transactions occur.

Key Features

- No Average Monthly Balance.

- Rs. 10 lakh can be kept as a maximum Balance.

- Cheque book available for the minor bank accounts.

PehlaKadam: The contact number of the account holder is recorded.

The bank issues a personalized checkbook with 10 leaves to the guardian in the name of the minor, specially designed for them.

PehliUdaan: Similar to PehlaKadam, the account holder’s mobile number is recorded. The specially designed cheque book containing 10 cheque leaves will be issued if the minor can sign adequately.

4. Photo ATM-cum-Debit Card is issued.

PehlaKadam: The ATM card is embossed with the child’s photo. It has a withdrawal/POS limit of Rs. 5,000. This ATM-cum-Debit card is issued in the name of the minor and guardian.

PehliUdaan: The Photo embossed ATM-cum-Debit Card will remain the same along with the withdrawal/POS limit of Rs. 5,000. The only difference is that it will be issued in the name of the minor.

5. Mobile Banking is enabled for a minor bank account.

PehlaKadam: It comes with viewing rights and limited transaction right. Some rights include Top-ups and Bill payments. The transaction limit is Rs. 2,000 per day.

PehliUdaan: The viewing rights include Top-ups, IMPS, and bill payments. The transaction limit is the same, i.e., Rs 2,000 per day.

6. Auto sweep facility is allowed. The minimum threshold is Rs. 20,000. You can sweep in the multiples of Rs 1,000/- with a minimum amount of Rs. 10,000/.

Documents Required to Open Bank Accounts for Minors

Some documents required to open a bank account for minors are given below:

- Birth certificate of the minor. This acts as proof of the age and relationship with the guardian.

- The bank may require address proofs and other necessary documents.

- Parent/ guardian’s signature.

Opening Bank Account for minors with HDFC

Here is a simple guide on how to open bank accounts for minors in HDFC bank.

Key Features

- The savings minor bank account also comes with a minimum balance requirement.

- The bank account for minors also has a maximum limit. Once this limit is crossed, the extra amount goes into a Fixed deposit. This deposit is made for one year in the minor’s name.

- The ATM/ Debit card is issued with a lower limit to check over-spending. In addition to this, the card is linked to the guardian’s contact. This prompts a notification whenever a transaction is done.

Procedure to Open Bank Accounts for Minors with HDFC

- The guardian must have an account with the bank that they want a minor bank account in.

- The bank will ask you to fill out a form. This form states that the minor is the first account holder, and you will act as a joint holder.

- Photographs of you and sometimes the minor are also asked.

- You will also need address proof documents like Pan Card and Birth Certificates.

- At last, you need to sign all the documents.

- The bank will verify everything. Post the verification; the minor bank account is up and running.

- Your bank will send the banking documents along with the chequebook.

Bank Accounts for Minors – FAQs

Are there any tax complications with the bank account for minors?

Ans. Yes, there are some things that you need to understand before opening a minor bank account. The taxing details will vary from state to state, so you must sit with a local attorney to understand the nitty gritty.

Is opening bank accounts for minors a good option?

Ans. Yes. A bank account for minors is one of the best things you can do for a child. This will help them in more than one way. You only need to be clear on your goal of opening a minor bank account and keep a monitor initially. Rest assured, bank accounts for minors are really a great idea.